Wild Rift players in the Asia Pacific region will now have to rely on third-party organizers to ensure the competitive scene stays afloat.

This is after a surprise announcement by the game’s developer, Riot Games, on Monday.

“While we’ve seen some incredible competition in the WRL, we’ve also seen that our grassroots and community-focused events in a number of regions have been very successful. We’ve decided to expand that approach to APAC,” Riot Games said in its statement.

Without addressing it directly, this means China will be the only market in the world where the Wild Rift League will operate, and Riot Games will simply rely on third-party tournaments to keep its esports scene alive in the Asia Pacific region.

“Our goal has always been to ensure Wild Rift players can participate in competition and foster a robust sense of community and belonging. We believe that pivoting to the model that relies on grassroots and community-led competition is the most sustainable and enabling path for APAC moving forward, giving players time and the space to grow and establish what role high-level competition will play in their community,” Riot said in its statement.

This means, having a Riot-operated tournament or even a world championship similar to the level of ICONS may not be held for the foreseeable future. Also, it is still unclear how Riot Games will support third-party tournaments and up to what specific forms of support will be extended to the game.

STIFF COMPETITION: PROOF IN THE NUMBERS

Fragster research shows that the Wild Rift League has been severely lagging behind two of its closest competitors in terms of viewership and interest outside of China.

Data from global esports statistics provider Esports Charts says that from a nearly five-year period from 2020 to early 2024, viewership of the game has been on a severe downward trend compared to other titles in its genre, such as Mobile Legends: Bang Bang and Honor of Kings – the latter being immensely popular within the remaining WRL market: China.

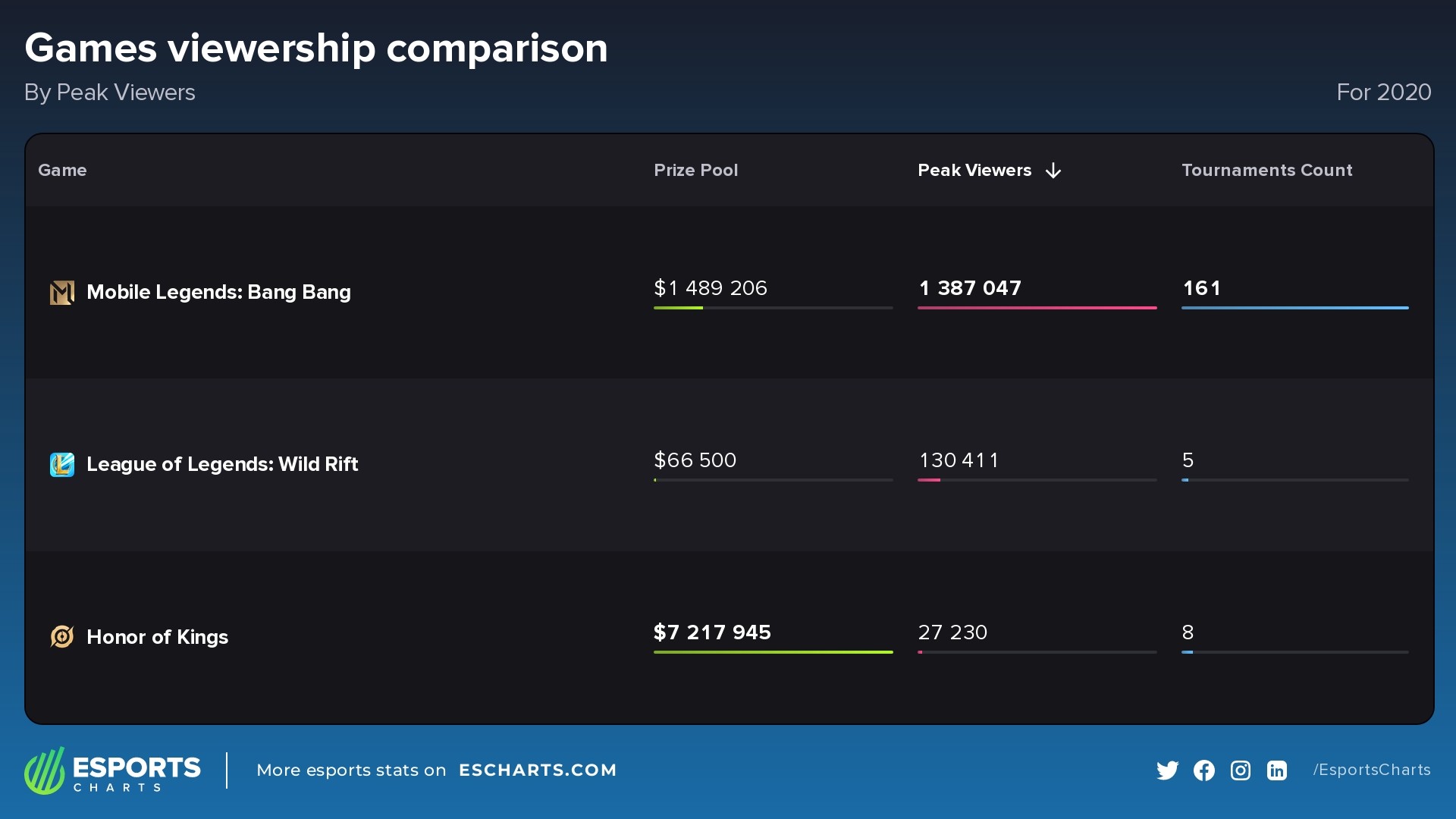

Viewership numbers presented by Esports Charts showed that Wild Rift failed to gain traction in terms of worldwide views, with its peak viewership only reaching a meager 130,411 when the game was launched in 2020.

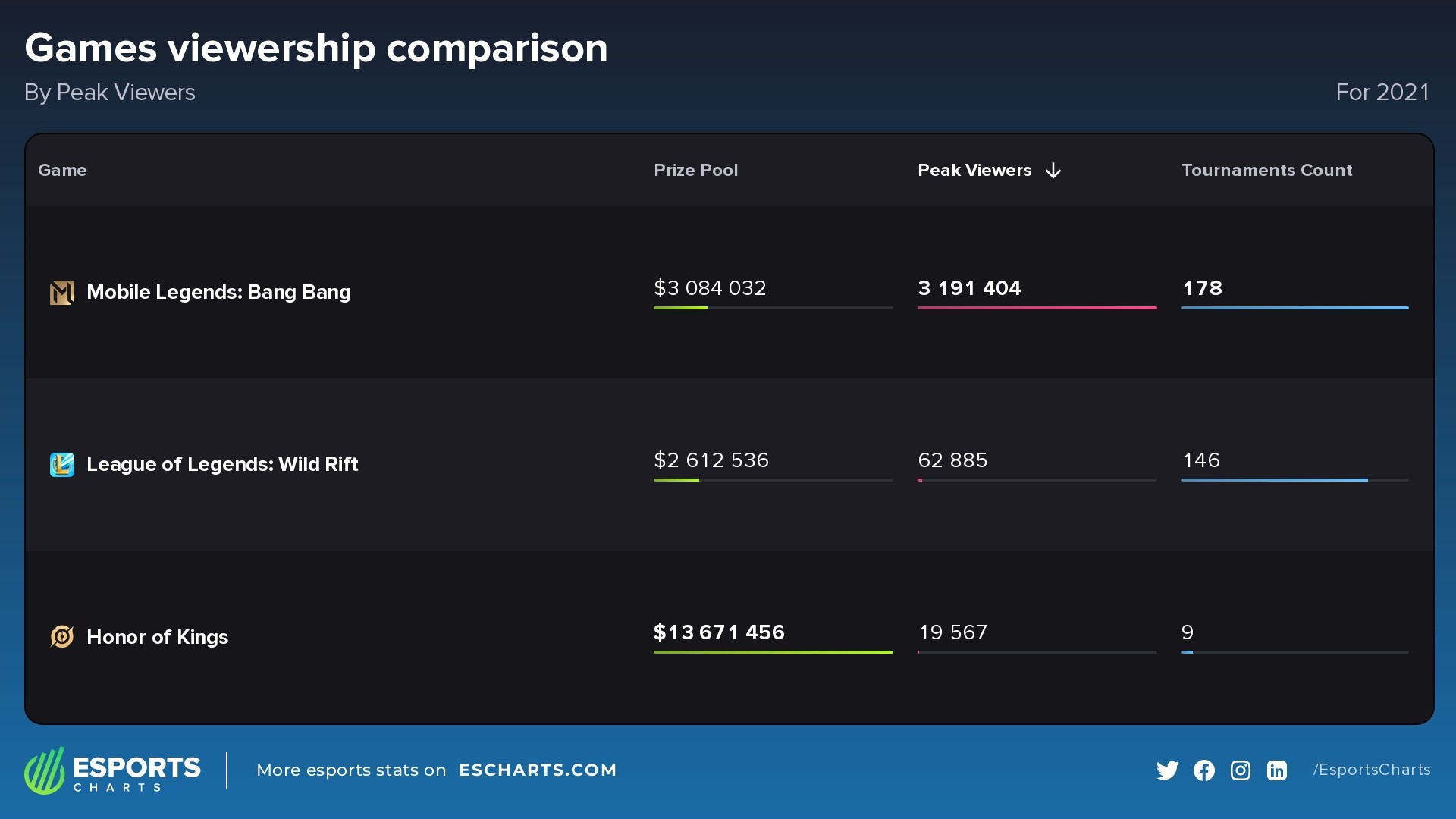

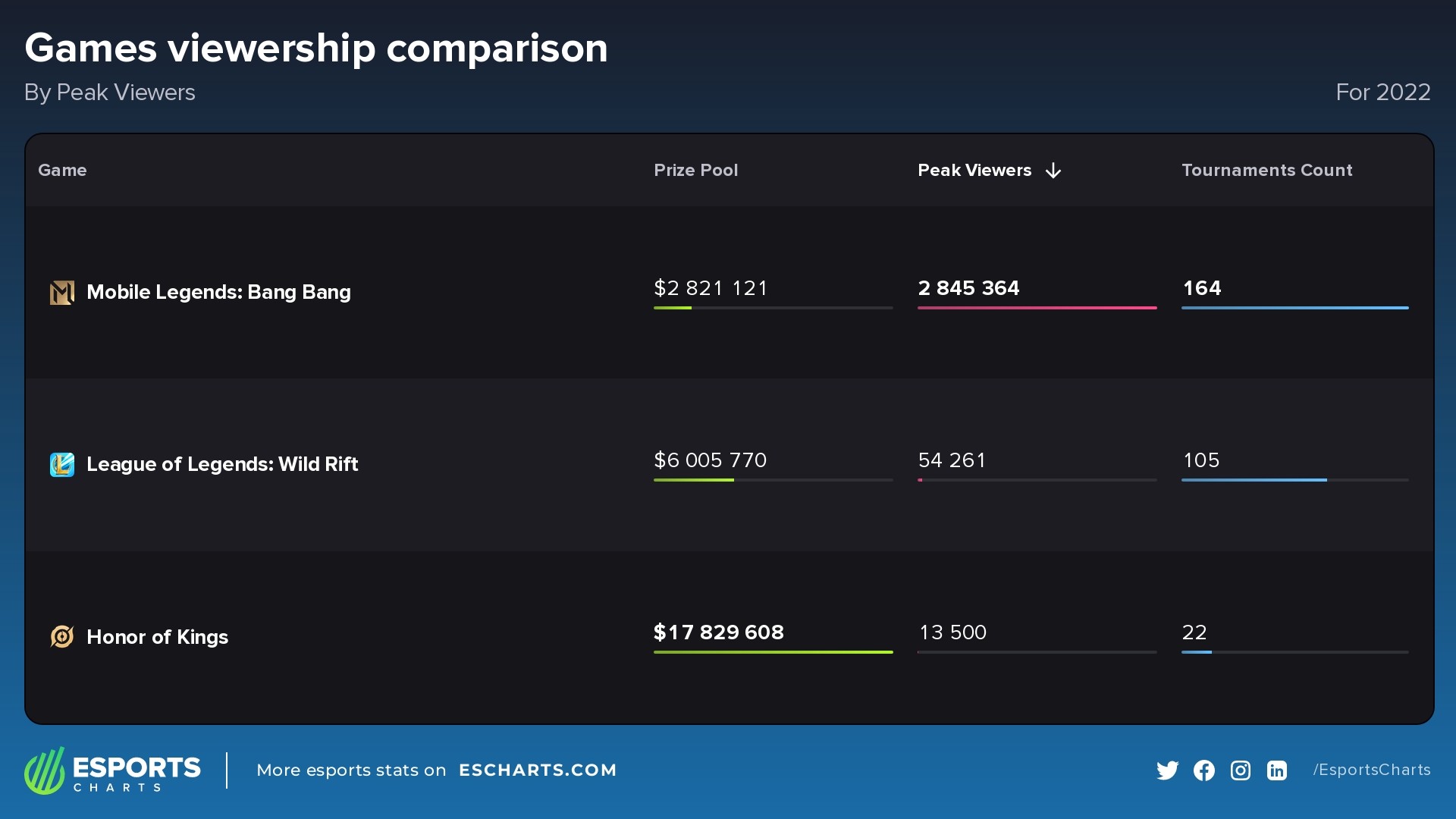

This was followed by a sharp decline in views: from 62,885 in 2021, to 54,261 in 2022. In 2023, the viewership was only at less than one-tenth of its 2020 peak, at 17,739, and hitting the four-digit mark of 9,897 in early 2024.

In comparison, Mobile Legends: Bang Bang enjoyed millions of peak viewers worldwide, starting out at 1.38 million peak views in 2020 right up until its highest viewed year ever in 2023, with the game garnering over 5 million peak views during its M5 World Championship.

As for Honor of Kings, the game was only made available globally in the first quarter of 2024, but its immense popularity in China allowed it to host multimillion dollar esports tournaments, reaching as much as US$17 million in 2023. Viewership globally may be small, but the trend is going upward as the game hit the 40,000+ peak viewership mark in 2024.

Data from escharts.com does not include streaming information from China due to the unreliability of streaming data for the said esports region.

Furthermore, the number of tournaments for Wild Rift paled in comparison to MLBB and Honor of Kings. from a peak of 146 tournaments in 2021, the tournaments went on a steep decline, from 105 in 2022, to just 18 in 2023, and finally, 5 so far in 2024.

This decision to scale back may also be because Riot Games earlier announced that they will only focus their Wild Rift esports operations in APAC and China.

The data also comes as MLBB and HoK are also offering multi-million dollar tournaments in the post-pandemic phase, with MLBB’s Mid-Season Cup set to become part of the 2024 Esports World Cup in Saudi Arabia and boasting a US$3 million total prize pool, and Honor of Kings developer Tencent announcing a US$15 million investment in the global HoK esports scene.

Esports.net also noted that the lack of content creator and esports support may have hampered Wild Rift’s player base, as investment in the game pales in comparison to other Riot Games titles such as League of Legends and Valorant.